Business interruption insurance: seven suggestions for ports

- Business

- January 30, 2024

Ports worldwide are facing numerous risks of business interruption in these uncertain times. The long list includes supply chain disruption, ship collisions, cyberattacks, political protests, strikes, and natural calamities.

Recent incidents have demonstrated that the threats are all too real. At the end of 2023, lock operators on the St. Lawrence Seaway went on strike for a week, reportedly costing the economies of the United States and Canada more than $70 million every day.

Approximately 150 ships—both oceangoing and lake freighters—were impacted by the eight-day closure.

According to reports in January 2024, an industrial conflict that started in October 2023 at several of Australia’s largest ports was accumulating tens of thousands of containers in backlog and generating expensive delays and supply chain disruptions.

Labor negotiations in 2023 had an impact on container shipping flows to the United States as well; forecasts of increased dockworker union activity this year would cause even more disruption.

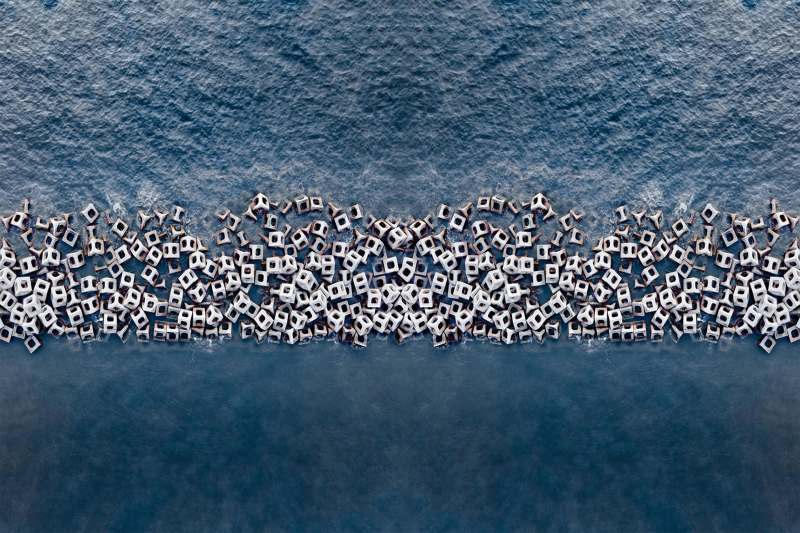

Regarding political demonstrations, in November 2023, in Australia, over 3,000 environmental activists in kayaks participated in a 30-hour blockade of the shipping lanes of Newcastle coal port in advance of the COP28 conference.

In addition, ports are still impacted by the “Great Supply Chain Disruption.” A number of post-pandemic problems, such as China’s scarcity of shipping containers and the paucity of truck drivers needed to transport commodities, are causing cargo to build up at ports and ships to get delayed in lines waiting to unload.

A cyberattack occurred in late 2023, disrupting terminals in Melbourne, Sydney, Brisbane, and Perth over the course of four days. This was similar to a hack where three Canadian ports were targeted by cyberattacks. Comparably, private data was leaked online as a result of a Port of Lisbon hack.

How can port operators make sure they have the best insurance possible and are completely insured against these diverse business interruption threats?

To develop a tailored insurance plan that takes into account the particular risks and difficulties the port and its operations confront, they must collaborate with insurance experts that specialize in maritime and port-related hazards.

This involves adjusting deductibles and coverage limitations to meet the unique requirements of the company.

Working with an experienced broker will assist port operators acquire coverage that covers all possible scenarios.

To find any weaknesses and put risk mitigation plans into action, regular risk assessments are also essential. Businesses with strong risk management procedures may receive better rates from insurers.

Here are some important insurance suggestions to assist:

Insurance versus Business Interruption:

Business interruption insurance that covers income losses due to disruptions from strikes, protests, or other events is required for port operations. This can include paying for additional costs, lost income, and continuing operations costs while the disruption is occurring.

Insurance for Real Estate:

Ensuring that the port’s physical assets, such as warehouses, equipment, and terminals, are sufficiently insured by property insurance is crucial. This ought to cover losses brought on by natural catastrophes, ship collisions, and other physical hazards.

Insurance for Marine Transport:

Vessel damage, particularly those resulting from port-related collisions, should be covered by marine insurance coverage. This can involve cargo insurance for items in transit, hull and machinery insurance, and protection and indemnity (P&I) insurance.

Insurance Against Liability:

In order to shield the port from lawsuits resulting from mishaps, crashes, or injuries sustained on the property, liability insurance is required. This may involve third-party liability insurance for harm to other boats, property, or personal injury.

Insurance Against Political Risk:

To guard against financial losses brought on by strikes, protests, or other political events that can interfere with company operations, think about purchasing political risk insurance. Consider the crisis in the Middle East, the war between Russia and Ukraine, or the tensions between the US and China. Ports that, for instance, attract investors from nations that can be subject to sanctions, may be significantly impacted by these kinds of dynamics.

Insurance for Contingent Business Interruption:

Losses from interruptions to important suppliers or clients are covered by contingent business interruption insurance. If a port depends on particular suppliers to run its operations, this could be quite important.

Insurance for Cybersecurity:

To guard against online threats and attacks that could interfere with port operations and cause business interruption, cyber insurance is crucial. The presence of numerous vessels run by businesses using various IT systems creates an ideal setting for cyberattacks.