Funding is raised by Singapore-based startup EduFi for its student loan platform

- Business

- November 11, 2023

EduFi, a fintech startup that empowers monetarily tied understudies to get credits for their schooling, has brought $6.1 million up in a pre-seed round drove by Zayn VC with cooperation from Palm Drive Capital, Consider Adventures, Q Business and private backers.

The Singapore-based startup has sent off a man-made brainpower controlled concentrate on now, pay later (SNPL) loaning stage and its versatile application in Pakistan, a country that doesn’t have understudy loan items as a class; all things being equal, clients take individual advances with exorbitant interest and extended process, Aleena Nadeem, organizer and Chief of EduFi, told TechCrunch.

EduFi needs to resolve the country’s two issues — high destitution levels and low proficiency rates — through its fintech stage. In Pakistan, around 40% of understudies go to tuition based schools because of state funded schools’ low quality, bringing about spending more than $14 billion on their schooling consistently. Also, more than half of the grown-up populace in Pakistan doesn’t approach monetary administrations, for example, financial balances and protection.

Nadeem, a MIT graduate who recently worked at Goldman Sachs and Ventura Capital, had seen direct numerous kids battle with monetary obstructions to get quality training while at the same time working at Moderate Schooling Organization (PEN) in Pakistan. PEN is a philanthropic association that gives free and quality schooling to youngsters who can’t manage the cost of it.

“Many children in Pakistan make it to high school, but there is a sharp drop in those who are able to achieve a higher college education,” Nadeem said. “This drop is where EduFi is trying to inject capital into the gap between high school graduation and first-year university admission.”

The two-year-old organization has proactively had associations with 15 colleges, permitting the application to be accessible to around 200,000 understudies who should pay their expenses for undergrad, Expert’s and PhD across Pakistan.

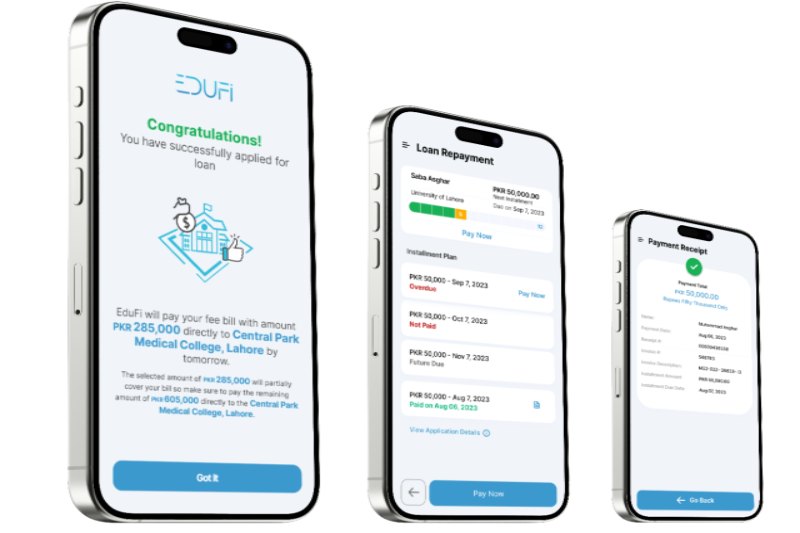

At the point when an understudy (or a parent) applies for credits by means of the application, EduFi requires the candidate’s (understudy or parent) monetary status. For instance, the past a year’s bank proclamations or a type of revenue that can uphold their credit reimbursements, like a salaried work, an independent company, or independent work. When an understudy loan office is endorsed, EduFi sends the cash straightforwardly to the school’s bank.