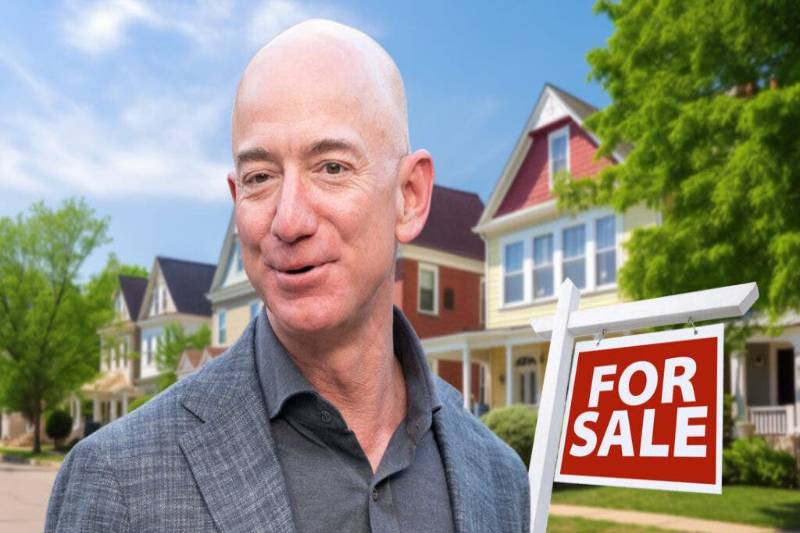

Jeff Bezos Funds a Startup Expanding Rentals of Family Homes

- Business

- December 6, 2023

To make it more simpler for regular Americans to bet on the rental properties of other regular Americans, a real estate investing business sponsored by Jeff Bezos is introducing a new fund.

Arrived is a company that was founded in 2021 and buys up single-family homes to rent out for as little as $100 to anyone who wants to invest. Up until now, Arrived clients could only buy shares in certain houses and were paid dividends on the rental income, thereby establishing a dispersed network of landlords.

The business now intends to make it simple for clients to invest in a variety of its rental properties, thereby financializing the housing market for an expanding group of fractional mini-landlords. With the company’s recently introduced “Single Family Residential Fund,” investors can invest in a fund that, like a Real Estate Investment Trust, invests in single-family houses throughout the company’s assets. A $100 minimum investment is also required for the fund.

The company highlighted that it is betting on single-family house rentals because fewer individuals can afford to buy homes and more people are trapped renting in a webinar last week promoting the new fund.

The business now intends to make it simple for clients to invest in a variety of its rental properties, thereby financializing the housing market for an expanding group of fractional mini-landlords. With the company’s recently introduced “Single Family Residential Fund,” investors can invest in a fund that, like a Real Estate Investment Trust, invests in single-family houses throughout the company’s assets. A $100 minimum investment is also required for the fund.

The company highlighted that it is betting on single-family house rentals because fewer individuals can afford to buy homes and more people are trapped renting in a webinar last week promoting the new fund.

Cameron Wu, vice president of investments at Arrived, stated during the same webinar that the company looks for properties that are “affordable enough today that you can get a good cash flow.” The company said that it is currently purchasing homes in Greeley, Colorado, which has “higher price points when compared to the country, but [is] more affordable when it comes to Colorado.” The company started off by purchasing houses in Fayetteville, Arkansas, where the co-founders of the company were formerly situated.

CEO Ryan Frazier stated that the company is profiting from the nationwide housing shortage later in the webinar.

“The supply of properties in the market has decreased now that mortgage interest rates have increased, and the single-family home residential home market has just been so undersupplied for more than the last decade,” Frazier said. “At the same time, there is an increase in people’s interest in renting properties.”

Prominent IT tycoons are rapidly growing fascinated by Arrived. Among the investors are Dara Khosrowshahi, CEO of Uber, Spencer Rascoff, co-founder of Zillow, and former CEO of Amazon, Jeff Bezos.

Frazier told Talk Business and Politics in 2019 that he started Arrived to give individuals an alternative to owning and renting a home. Frazier had previously developed a business that analyzed social media conversations for market data.

Naturally, Arrived is making fewer single-family houses available for purchase while simultaneously increasing the number of rental properties available, which exacerbates the issue it is making money from. This has long been a complaint leveled at purchases of single-family homes financed by private equity, which have surged significantly since the pandemic. According to Stateline, 25% of all homes sold in 2021 went to investors, and 28% of all homes sold in 2022 went to investors, according to Pew Charitable Trusts.

Although only about 5% of single-family homes were owned by investors as of 2022, Yardi, a company that also makes single-family home investments and was recently named in a class action price fixing lawsuit, estimates that by 2030, investors will own 40% of the single-family home market.

Currently, the organization has over 300 properties for investment listed nationwide, including properties in Virginia, Tennessee, and Arkansas. As per Arrived, around 500,000 individuals have made investments in their homes thus far.

Arrived’s portfolio is small in comparison to larger players such as Invitation Homes, which asserts to own 80,000 single family homes nationwide, and Tricon Residential, which claims to own roughly 35,000 homes; however, Arrived’s growth indicates that venture capital money is also making a bet on the country’s housing stock.

Companies with substantial investment resources are increasingly taking over landlord responsibilities as mortgages become more out of reach for average homeowners, all the while letting consumers participate for just $100.